Six-time award winner.

Every year, Fundata Canada Inc. presents FundGrade A+* awards to acknowledge Canadian investment funds that have maintained exceptional performance ratings. The VPI Canadian Balanced Pool is a six-time award winner in its peer group in 2018, 2019, 2020, 2021, 2022, 2023.

*Award is provided by Fundata Canada Inc. Visit https://www.fundgradeawards.com/ for more details.

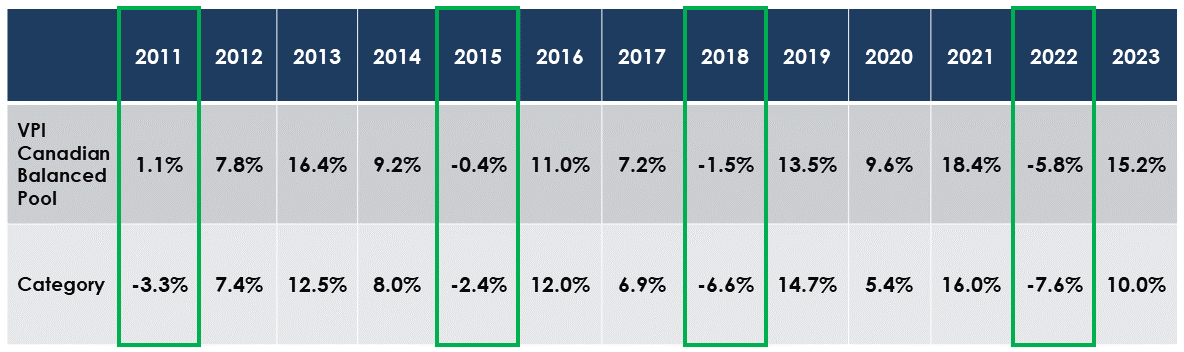

Out-performance in key years.

The pool has a proven history of growing and protecting client capital.

Table shows Total Return %

for the indicated calendar years as of December 31. VPI Canadian Balanced Pool Series A units.

Category is Canadian Equity Balanced. *Please see the bottom of the page for more information on the category comparison. Source: Morningstar

Able to travel up and down the market cap spectrum.

Successful balanced funds often get big and then have difficulty taking a meaningful ownership stake in smaller companies…thus falling victim to their own success.

The VPI Canadian Balanced Pool owns a mix of large and small cap companies.

*Canadian Investment Funds Standards Committee (CIFSC) developed a

classification scheme for mutual funds in Canada in order to provide

stakeholders with another way of comparing funds with similar strategies and

principles. The VPI Canadian Balanced

Pool is categorized under Canadian Equity Balanced (the Category). Funds included in the Category must invest at

least 70% of total assets in a combination of equity securities domiciled in

Canada and Canadian dollar-denominated fixed income securities. In addition,

they must invest greater than 60% but less than 90% of their total assets in

equity securities. Morningstar compares the performance of the mutual funds in

the Category and determines the quartile ranking for different time periods.

This comparison to funds in the Category is provided for information purposes

only and comparison has limitations. Although

the Funds in this category will have similar characteristics, it is important

to note there may be significant differences in the companies held, thus

performance between funds in this category can differ significantly. The VPI

Canadian Balanced Pool also has concentrated investments in a limited number of

companies compared to some funds in this Category. As a result, a change in one

security’s value may have more effect on the Pool’s value as compared to the

performance of funds in the Category.