Impressive long-term track record. Same portfolio manager for 18 years.

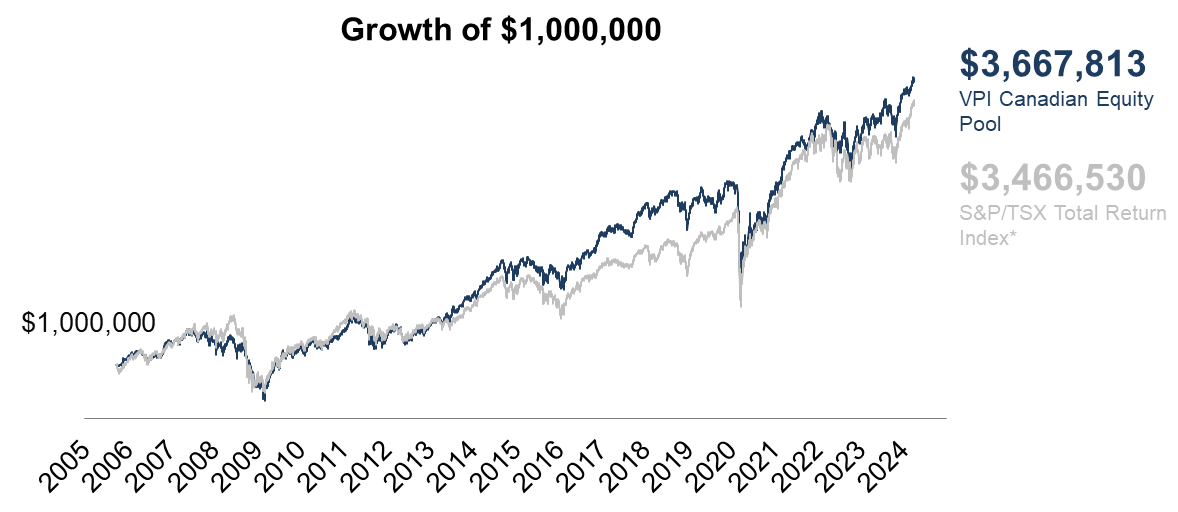

The VPI Canadian Equity Pool has an impressive long-term track record. If you invested $1,000,000 into the pool at inception, you'd have more than $3,600,000 today.

Notes:

Growth of $1 million invested in the VPI Canadian Equity pool - Series A with

the following rebate schedule: 0.5% for $0.5M - $1M, 0.55% for $1M - $2.5M, and

0.6% for $2.5M+. See the VPI Management Fee Reduction Program for additional

details. Chart begins at inception of the fund (September 26, 2005) to March 31, 2024. Please see the disclaimer at the bottom of this page for information on the benchmark comparison. All figures in $CA. Source: Value Partners

Investments, S&P Capital IQ.

Is The Stock Market In A Bubble? Is Your Portfolio In A Bubble?

The VPI Canadian Equity pool only invests in high quality businesses purchased at attractive valuations. Watch the video below to see how that translates into higher returns for investors.