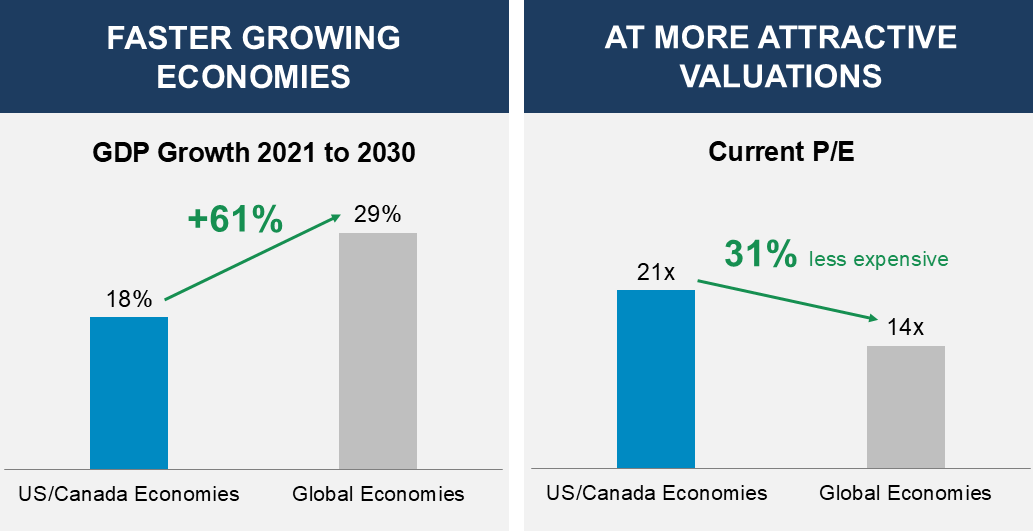

Access to Faster Growing Economies.

International economies account for virtually all future population growth, they also offer a far larger opportunity set, with 3x the number of public companies generating 3x the amount of revenue.

Note: Population growth shows

estimates over the next 10 years based on IMF data as of January 12, 2024.

Public company and corporate revenue data is derived using Bloomberg as of May

31, 2025. Corporate revenue is denominated in trillions CAD and reflects the

top 5,000 companies from both International Economies and US & Canada

public company subsets (descending order in terms of revenue).

Attractively Valued.

In addition to faster growing economies, investing globally allows us to purchase dominant businesses at more attractive valuations. These businesses are well suited to provide long-term growth.

Note: GDP Growth shows simple

average of Real GDP growth estimates from the OECD for the US and Canada

compared to countries the VPI Global Equity Pool invests in. P/E shows simple

average forward price to earnings for the SPX Index and the SPTSX Index compared to the broad market indexes

of countries the VPI Global Equity Pool invests in. All values as of December 31, 2024. Source: Bloomberg L.P,

OECD.